How To: Set up Labor Distribution on an Employee Record

Wages, Deductions, and Taxes can be assigned automatic allocations using the Labor Distribution profile.

To create a Labor Distribution Profile, navigate to Company Settings > Profiles/Policies > Labor Distribution

To create a new profile, click the Add New Profile button

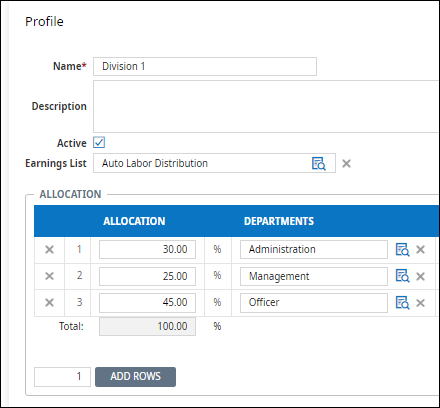

Complete the following sections and fields:

- Name: Enter the name of the labor distribution profile.

- Description: Enter a description related to the labor distribution.

- Active: Uncheck this box to inactivate this labor distribution profile.

- Earnings List: Click the Lookup icon to select an Earnings List. If you don't see an appropriate list, you can create one directly from this page by clicking the New Earnings List button. You can also build an Earnings List from other areas in the system. But, most commonly, you build an Earnings List in each earning code, where you attach an earning to an existing list or create a new one.

- Allocation Section: Enter the allocation for distributing this profile among cost centers. There is no limit to the number of allocation rows for the profile. However, a total allocation of 100 percent is required. The system does not allow you to save the profile without a 100 percent total in this section.

To add rows, click the Add Rows button. Enter a number next to the Add Rows button to create multiple rows.

When the profile is completed, click the Save button.

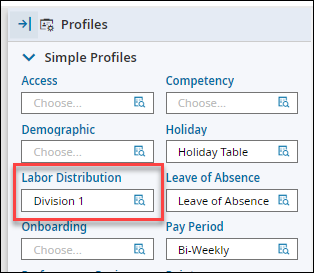

To assign the Labor Distribution Profile to an employee, select the applicable profile on the employee's Labor Distribution Profile selection.

This profile will allocate Scheduled Earnings to the labor distribution profile.

To allocate additional earnings, such as time off earnings to the profile, select the Labor Distribution Pay Prep profile. If you do not have this option, contact AtlasHR to have this profile created.

Popular Articles

How To: Add Workflow Delegation for Backup Approval

If a manager/approver is out of the office for a period of time, Workflow Delegation can be set up to assign a different manager to handle approvals during their absence. Delegations can be add by the employee prior to their absence or by the Admin ...How To: Enter a Manual Check

Enter the Payroll Prep for the next scheduled payroll date Select View Pay Statements in the Add/Edit Pay Statements Payroll Prep step. Do not Initiate Payroll or Sync Time Select New Pay Statement Create a new pay statement using the Manual Pay ...How To: Submit a New Tax Withholding Form

Changes to withholding form, such as the IRS Form W-4, can be initiated directly in the system by an employee and approved by HR. Once processed, all changes will be automatically updated on the employee record and applied to the next payroll ...How To: Enroll in Benefits For Life Change Event

To enroll in benefits as the result of a life change event, such as the birth of a child, adoption, marriage, divorce, etc. select Start a new life change event on the My Benefits widget: You may also navigate to My Benefits > Enrollment > Life ...How To: Consent to Electronic Year-End Form Delivery (W2 or 1099)

To grant consent for electronic year-end forms, navigate to My Info > My Pay > Forms > W2 or 1099-NEC Click the Electronic Consent button Check the box to Receive Form W2 Electronically and confirm the update with your password Once you have ...

Related Articles

How To: Change Labor Allocation in a Pay Statement

To update an employee's pay statement cost center allocation, navigate to Payroll Prep / View Pay Statements edit the employee pay statement. Add columns to the employee's pay statement to allow you to select a cost center In the employee's pay ...How To: Set up a Garnishment Order on an Employee

On the employee's profile, under Deductions, select Deduction Wizard Select the type of garnishment deduction Click Next and enter the remaining information Start Date: date the deduction will start Issue Date: from the order paperwork ID # (Case ...Employee Missouri Probationary Code

According to the Missouri Department of Labor, an "individual who performed services for an employer for 28 consecutive calendar days or less, is considered a probationary employee for UI purposes, regardless of employer’s company policy. These wages ...How To: Set Up An Employee With Paid Company Holidays

In order for employee's to get paid holidays, they need to have two profiles assigned to them: Holiday Profile: Assigns a holiday table to determine which dates are company paid holidays. TS Auto Population: Automatically populates the time off hours ...How To: Setup Employee with Salary Autopay

In order for a salary employee to be automatically paid a salary amount each pay period, the Autopay settings will need to be enabled. Navigate to the Employee Profile > Base Compensation > Current Compensation Select View/Edit under Actions The ...